Bribery is a common example, such as when a business offers financial payments to an official in exchange for favorable treatment, or an organized crime outfit pays law enforcement officials to look the other way.Īny of the offenses described above, when committed by or on behalf of an organization established to carry out illegal activity, are known as racketeering or “organized crime.” Organized crime is usually not considered a type of “white collar crime,” but it often involves many of the same criminal statutes. Public corruption, by which public officials misuse their authority for financial gain, is also considered a financial crime. It also potentially harms the economy by destabilizing the currency. Money counterfeiting may harm merchants who accept counterfeit bills, believing they are genuine. Insider trading, for example, is considered an unfair advantage in the market, which is damaging to investors who do not have access to inside information. Some financial crimes do not target a specific person or business, but they are considered criminal because they have an overall negative public impact.

Offenses that involve theft of money or something else of value, but that do not involve the threat or use of force, may be considered financial or white collar crimes. Before that, financial upheavals like the savings and loan scandal of the early 1980s and the Enron scandal of the early 2000s also saw prosecutions for various white collar offenses.

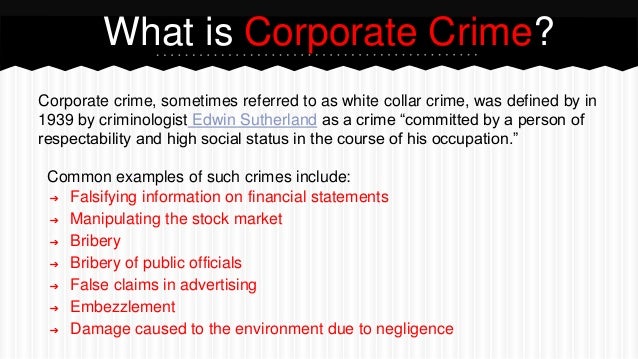

The Federal Bureau of Investigation (FBI) offers a simplified definition of white collar crime: “lying, cheating, and stealing.” The Wall Street crisis that began in 2008 brought prosecutions for fraud and other financial offenses, although many critics might say that far too few prosecutions have occurred. Sutherland’s ideas have informed the laws regarding white collar and financial crime ever since.

DEFINE FINANCE CRIME PROFESSIONAL

He noted that police seemed to focus their attention on crime among the “lower class,” while ignoring crimes committed among “business and professional men,” people he described as “merchant princes and captains of finance and industry.” The “robber barons” of the late nineteenth century, he stated, were white collar criminals, but they were not as “suave and deceptive” as those of the Great Depression era. Often, this kind of business fraud is designed to give an. Sociologist Edwin Sutherland is credited with coining the term, using it for the first time in a speech to the American Sociological Society in Philadelphia on December 27, 1939. Corporate fraud refers to illegal activities undertaken by an individual or company that are done in a dishonest or unethical manner. No single definition of “white collar crime” exists in the law. The term "white collar crime" was coined in 1939.

0 kommentar(er)

0 kommentar(er)